RELEASE: Chairs Thompson and Stabenow introduce Farm Bill Frameworks

[PASADENA, CALIF., UNITED STATES, May 2, 2024] — CAFB and GRACE/End Child Poverty Urge California Members to reject cuts and Instead Strengthen SNAP

This week, House and Senate Agriculture Committee Chairs Rep. Thompson and Sen. Stabenow released starkly different frameworks outlining their vision for the next Farm Bill. While Sen. Stabenow’s plan lays out a promising plan to protect and strengthen our country’s most important anti-hunger program — SNAP, or CalFresh in California – Rep. Thompson’s plan proposes deep, shortsighted, and harmful cuts to SNAP that will worsen hunger for the more than 5 million Californians who rely on the program today.

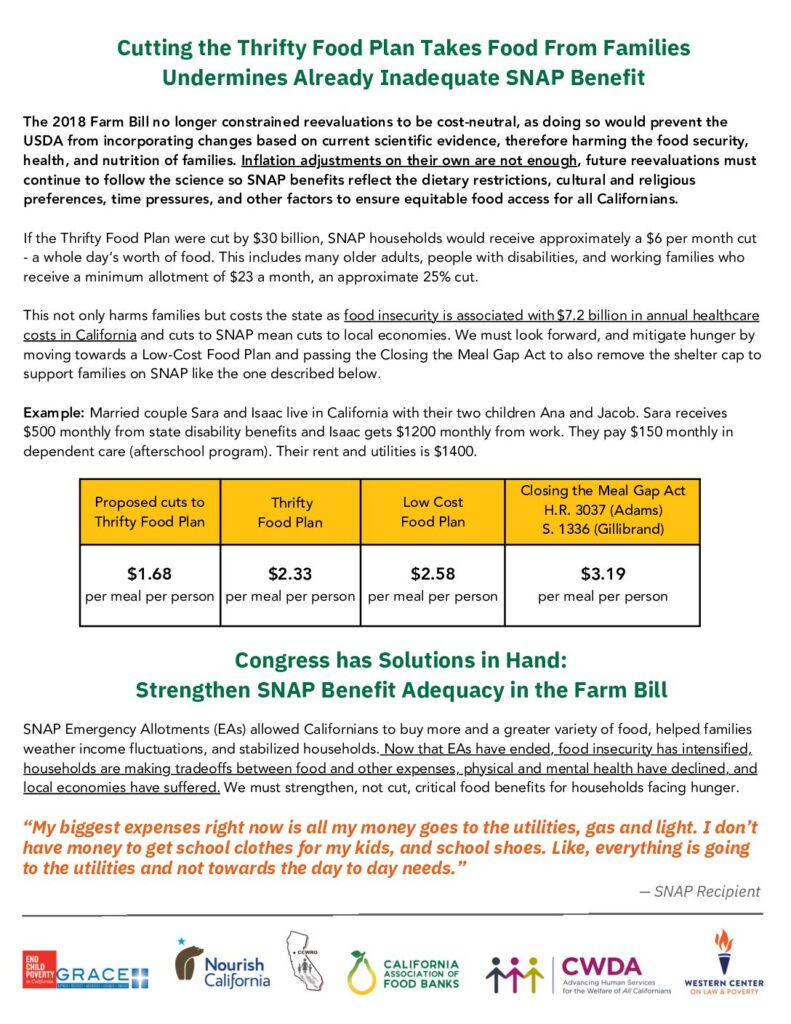

Specifically, Chair Thompson’s proposal includes forcing cost neutral reevaluations which will prevent the USDA from being able to make much needed periodic updates to the Thrifty Food Plan (TFP), which is the basis for SNAP and other nutrition programs like The Emergency Food Assistance Program (TEFAP) and Summer EBT. In no uncertain terms, this would cut SNAP by about $30 billion over the next decade by restricting future updates to only count for inflation, ignoring science-based changes to dietary guidelines.

Hungry Californians would be harmed the most: Approximately $3.6 billion, or 12% of the $30 billion cut to SNAP would be taken from the 5 million Californians who spend SNAP benefits at 23,874 authorized EBT retailers across our state. This represents a loss of as much as $6.46 billion in total economic activity, hurting farmers, farmworkers, truckers, grocers, and others across our critical food sector.

Even after the recent TFP reevaluation, SNAP benefits still only average $6 per person per day – barely more than a cup of coffee, and still fall short of the cost of low-income meals in 98% of California counties.

Forcing cost neutral Thrifty Food Plan reevaluations is not only a SNAP cut but will also impact other critical nutrition programs like the TEFAP and Summer EBT. These simultaneous cuts will hamper the ability of food banks to serve their communities, and will increase hunger for children during summer months when school is out.

In sharp contrast to Chair Thompson’s proposal, Chair Stabenow lays out a forward-looking framework that builds on several of SNAP’s strengths to prevent hunger, fundamentally by preserving future Thrifty Food Plan re-evaluations, in addition to:

- Removing the punitive drug felon ban and better supporting people coming home from incarceration to apply for SNAP, proven to support a healing re-entry to community.

- Permanently ensuring that SNAP recipients who are victims of benefit theft such as “skimming” that has ravaged Californains can have their benefits replaced.

- Exploring pathways for SNAP recipients to purchase hot and prepared foods.

- Finally securing a pathway to SNAP for Puerto Rico.

At a time when 1 in 5 households in California are experiencing hunger with deep disparities for communities of color, we call on the California Congressional Delegation to prioritize bold policy solutions through:

- The Closing the Meal Gap Act (H.R. 3037 Adams / S. 1336 Gillibrand) which would move SNAP benefit calculations to the more realistic Low Cost Food Plan

- The Improving Access to Nutrition Act (H.R. 1510 Lee / S. 2435 Welch) which would repeals SNAP’s harsh and counterproductive three-month time limit for out-of-work Americans and improves SNAP access for families working their way up the economic ladder

- The Enhance Access To SNAP Act (H.R. 3183 Gomez / S. 1488 Gillibrand) which would eliminate the outdated and unfair SNAP restrictions for college students

SNAP Emergency Allotments (EAs) allowed Californians to buy more and a greater variety of food, helped families weather income fluctuations, and stabilized households. Now that EAs have ended, food insecurity has intensified, households are making tradeoffs between food and other expenses, physical and mental health have declined, and local economies have suffered.

We urge all California Members of Congress to reject any cuts to SNAP, including to the Thrifty Food Plan, and to build on the Senate framework to strengthen SNAP and the emergency feeding programs as our nation’s proven anti-hunger safety net.

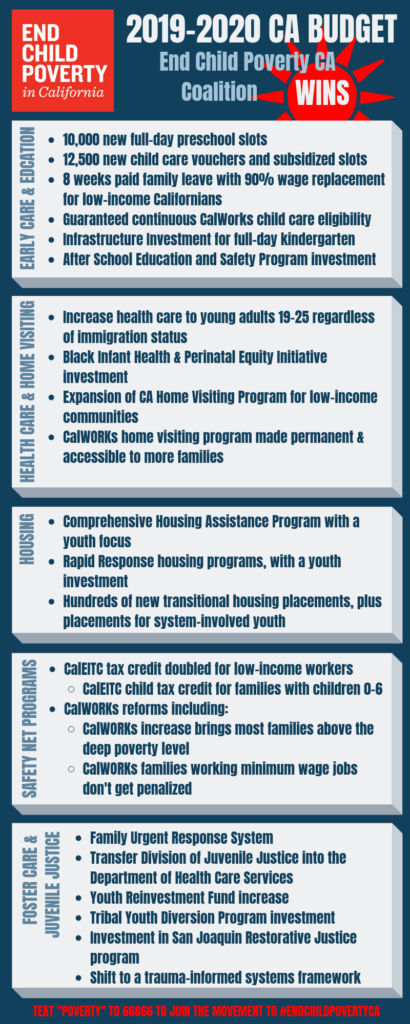

End Child Poverty in California (ECPCA) is a campaign jointly sponsored by GRACE End Child Poverty Institute and GRACE (Gather, Respect, Advocate, Change, Engage).

GRACE End Child Poverty Institute is a 501(c)(4) nonprofit organization that uses advocacy, legislative advocacy and mobilization programs to achieve its mission. The mission of GRACE End Child Poverty is to make a positive difference in the lives of low-income families and their children through value-based collaborations and by formulating, implementing, and expanding measures to reduce barriers to full personal development and economic stability.