RELEASE: GRACE & End Child Poverty CA Statement on Proposed Federal Tax Deal

ECPCA & GRACE urge Congress to improve the poverty-fighting potential of this package and to adopt proposal, benefitting more than 2 million children in California left out of the CTC under current law

[PASADENA, CALIF., UNITED STATES, January 16, 2024] — Statement attributable to Shimica Gaskins, President & CEO, GRACE & End Child Poverty California (ECPCA):

Today, chairs of the Senate Finance Committee and House Ways and Means Committee announced a deal that would be transformative to roughly 77% of the children nationwide whose families have been unable to claim the federal Child Tax Credit (CTC) since the pandemic-era expansion expired in 2021. Biden expanded the CTC under the American Rescue Plan Act, giving cash to families who needed it most and directly benefiting over 8 million children in California alone. This version of the CTC – one that offered larger credit amounts, was inclusive of children regardless of immigration status, fully refundable, and without an earnings requirement – remains our North Star. We remind stakeholders of the historic rise in poverty after its expiration and that ending poverty is a policy choice.

The Tax Relief for American Families and Workers Act of 2024 has meaningful restorations that make the refundable portion of the credit larger for families, especially those with multiple children. Initial estimates are that once the deal takes full effect, over half a million children would be lifted out of poverty, likely including tens of thousands of California children.

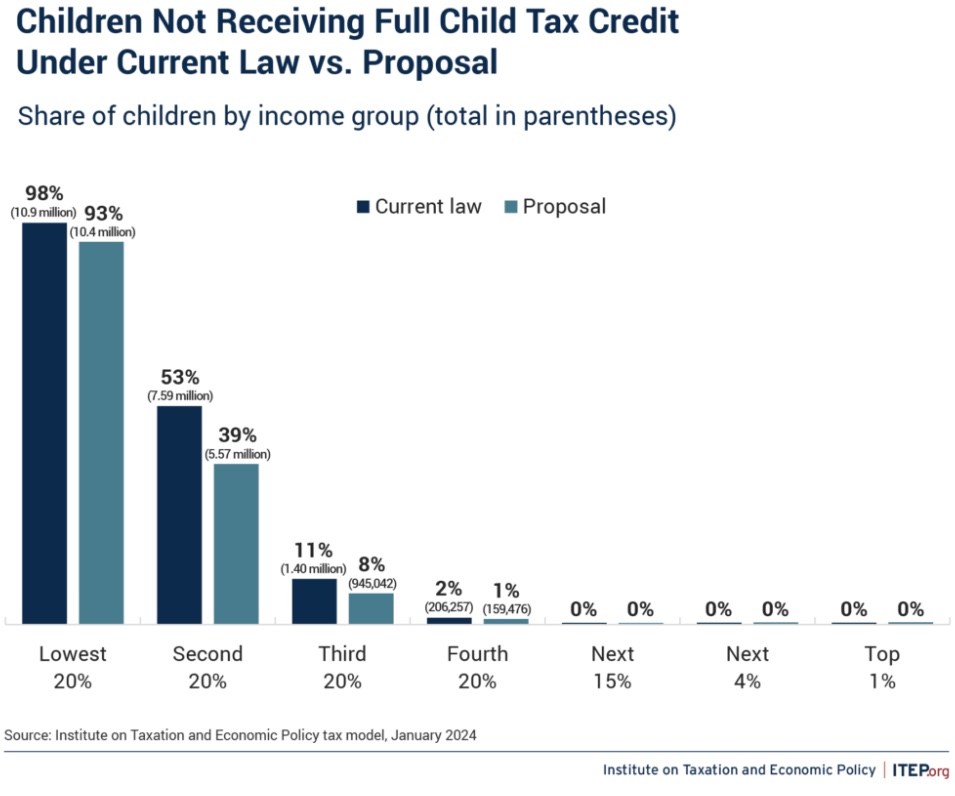

Given the proven record of the enhanced CTC, this deal falls short of what our families need and deserve – including children with Individual Taxpayer Identification Numbers (ITINs), full refundability, especially for low-income families, removing the arbitrary $2,500 earnings requirement, and increasing the overall size of the credit. Under current law, 98% of children in families in the lowest 20% tax bracket do not receive the full CTC, and the Wyden-Smith proposal only brings that figure down to 93%.

Ultimately, this means that more unrestricted cash will largely not flow to the lowest-income families. Our families deserve more, and we know Congress is up to the task – we proved as much in 2021. These important, yet modest, improvements in the CTC are also paired with tax breaks to corporations which are projected to balloon in cost over time and threaten the parity of this package.

We therefore urge members of Congress to improve the poverty-fighting potential of this package and quickly take action to pass this proposal, benefitting more than 2 million children in California left out of the CTC under current law. This deal is an important step towards ending poverty nationwide, and we thank the California members fighting to maximize the poverty-fighting focus of these provisions.

Congress should prioritize investments in our nation’s children on their own, and should not need to be tied to other provisions that do not advance a more redistributive system of revenues and investments. Nevertheless we urge Congress to swiftly enact these provisions in order to ensure children and families benefit in time to file their taxes, then to continue making strides that bring us back to the expanded CTC under ARPA, providing what families truly need and advance an end to child poverty.

Infographic Source:

Hughes, Joe. (2024). Children Not Receiving Full Child Tax Credit Under Current Law vs. Proposal [Infographic]. Institute on Taxation and Economic Policy. https://itep.org/congress-tax-deal-child-tax-credit-corporate-tax-breaks/

End Child Poverty in California (ECPCA) is a campaign jointly sponsored by GRACE End Child Poverty Institute and GRACE (Gather, Respect, Advocate, Change, Engage).

GRACE End Child Poverty Institute is a 501(c)(4) nonprofit organization that uses advocacy, legislative advocacy and mobilization programs to achieve its mission. The mission of GRACE End Child Poverty is to make a positive difference in the lives of low-income families and their children through value-based collaborations and by formulating, implementing, and expanding measures to reduce barriers to full personal development and economic stability.