RELEASE: California’s Final Budget Protects the Safety Net; ECPCA Coalition Commits to Further Advocacy

GRACE & the End Child Poverty CA Coalition Look Forward to Adoption of a Final State Budget that Protects the Safety Net; Urge Continued Action to Ensure the Revenues Needed to End Child Poverty in California Are Achieved

[Pasadena, Calif.] – Statement attributable to Shimica Gaskins, President & CEO, GRACE & End Child Poverty California (ECPCA):

This weekend, Governor Newsom and California legislative leaders announced the 2024-25 state budget agreement. The GRACE & the End Child Poverty CA Coalition supports this budget agreement, as it prioritizes proven safety net programs that support Californians experiencing poverty, even as the state faced a budget shortfall. We are grateful to the many parents and children who bravely spoke up and advocated for the outcomes achieved in this agreement, and we thank the Governor and legislative leaders for heeding their call.

This budget walks the walk to put our values first, making difficult choices that prioritize the most vulnerable Californians. We applaud Governor Newsom and legislative leaders for preserving vital safety net programs that provide cash, child care, food, health care, and other supportive services. This budget learns the lesson that austerity is a failed policy and sets the new standard that the anti-poverty safety net must be protected during a deficit.

Shimica Gaskins, GRACE & End Child Poverty CA President & CEO

The final budget agreement reflects a commitment to prioritize proven anti-poverty programs and reject failed austerity measures (across-the-board cuts) that have been relied on in the past. California has historically cut from the very programs that support people to overcome poverty and move into the middle class. A budget is a reflection of our values, and it must protect those hit hardest by the rising costs of basic needs. Austerity cuts were the previous playbook and they pushed Californians – disproportionately Black, Brown, Immigrant, and Indigenous families – deeper into poverty. This budget establishes a new blueprint for how California safeguards family and child stability when a budget crisis hits.

We extend our gratitude to Governor Newsom; Senate President Pro Tem McGuire; Assembly Speaker Robert Rivas; Budget Chairs Asm. Jesse Gabriel and Sen. Wiener; and Subcommittee Chairs Asm. Alvarez, Asm. Jackson, Sen. Laird, Sen. Menjivar, Sen. Padilla, Asm. Quirk-Silva, and Asm. Weber for this final budget agreement that prevents permanent and irreversible harm to children living in poverty.

California’s leaders demonstrated their shared values to prioritize ending child poverty, despite a looming deficit, including:

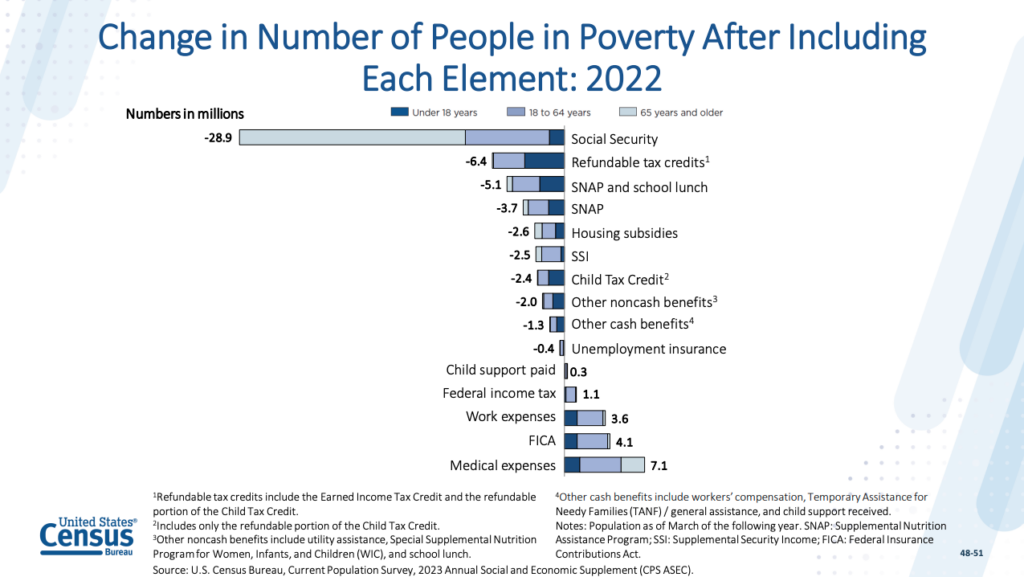

- The Governor’s protects core cash grants in CalWORKs and Supplemental Security Income/State Supplementary Payment (SSI/SSP) and supports healthy school meals for all as well as the Summer EBT program, the first new federal entitlement in a generation.

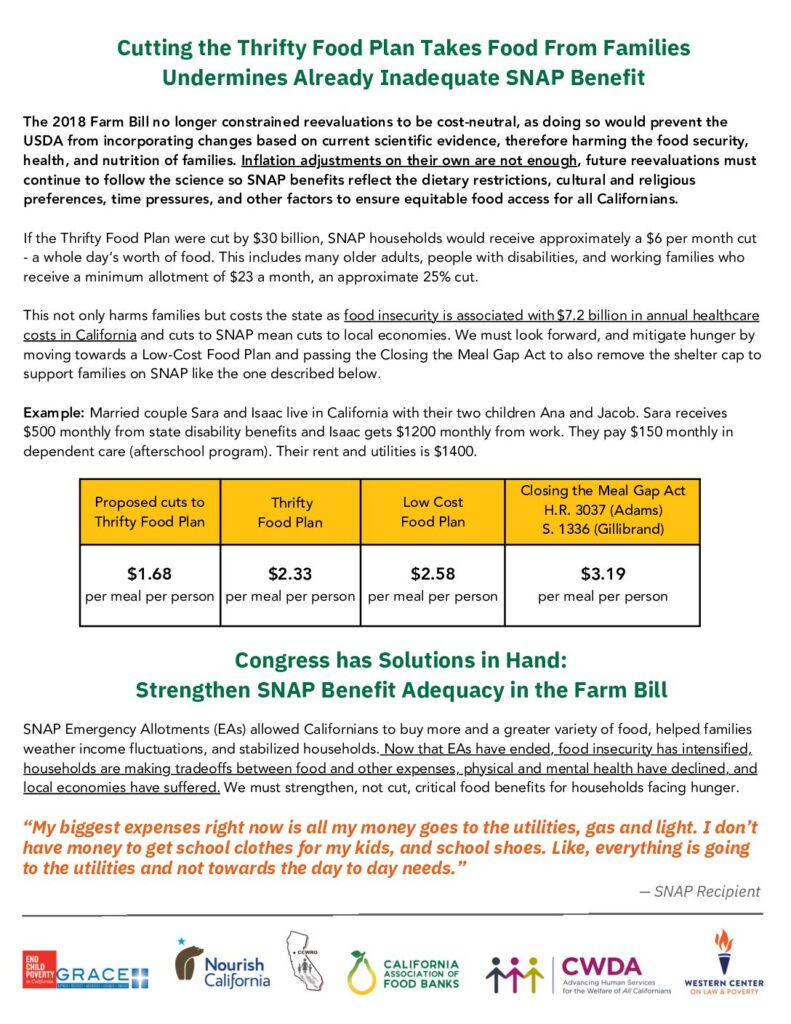

- The Legislature’s budget rejected cuts that would have meant irreversible harm to children and families by restoring life-saving programs across CalWORKs, child care, In-Home Support Services, CalFresh, and other vital anti-poverty programs.

The budget also includes important actions to continue increasing workers’ wages. We underscore our commitment that increasing wages is critical to reducing poverty, and moving families beyond eligibility for public benefits and toward the middle class.

Furthermore, the budget agreement maintains the Summer Bridge Fund, keeping classified providers at schools and reinforcing summer wages for school meal providers who are essential to maintaining California’s nation-leading universal school meals and other child nutrition programs.

In addition, we applaud actions to find budget savings by deactivating prison housing units and some actions to temporarily limit corporate tax breaks.

We urge the Governor and Legislature to permanently make California’s revenue system more equitable by ensuring wealthy corporations pay their fair share.

Despite these significant wins for families, we are disappointed that the final budget:

- Misses a key opportunity to build on the Governor’s leadership to pursue federal CalWORKs pilots with family-centered changes that align with federal guidance calling for innovations to “re-envision” employment and training to meet family’s unique needs,

- Delays Food For All for older adults regardless of immigration status to 2027,

- Cuts Free Tax Prep Assistance Education & Outreach for low-income tax credits in half to $10M, and

- Draws down the entire $900M Safety Net Reserve over the two-year budget window, rather than pursuing other revenue generating opportunities.

While we’re disappointed that this budget hasn’t provided the opportunity to do even more to end child poverty, we support this budget agreement because it preserves progress and prevents devastating cuts, setting the new standard for budgets during future deficits. The significant actions taken during this administration toward the Governor’s North Star to end child poverty underscore that the constraints this year are from limited resources, not a lack of commitment.

We are eager to work with all stakeholders to implement and build on the actions in this budget. Together, we can build a California where every child is valued and free.

Stay tuned for a full 2024-25 Budget summary and analysis.